By not investing in quality early childhood education, we're leaving vulnerable kids behind and lots of future benefits on the table.

It is widely agreed that while we do not seek equal outcomes in America, we do aspire to equal opportunity, at least in theory. We have, however, never come close to that ideal, particularly as regards minorities and those with few resources. A great way to correct that is to invest more national resources in early childhood education.

Moreover, given rising economic inequality, the rationale for this idea is more pressing than ever. Other advanced economies, as you will see, are way ahead of us on this point.

As inequality has risen, the barriers to opportunity to the least advantaged have risen as well. Much data supports this case, both statistical and anecdotal. Robert Putnam’s recent book has both. Economist Raj Chetty’s highly touted research shows strong, negative correlations between kids growing up in poor neighborhoods and their outcomes as adults.

As private resources become more unequal and thus, as I show below, relatively less available to children growing up in opportunity-constrained situations, we need to devote more public resources toward improving their life chances. The fact that we are not doing so is the most portentous public policy mistake we’re making.

A bold assertion, I know, but I make it based on the uniquely high quality of the research showing the large net benefits of early-childhood investments.

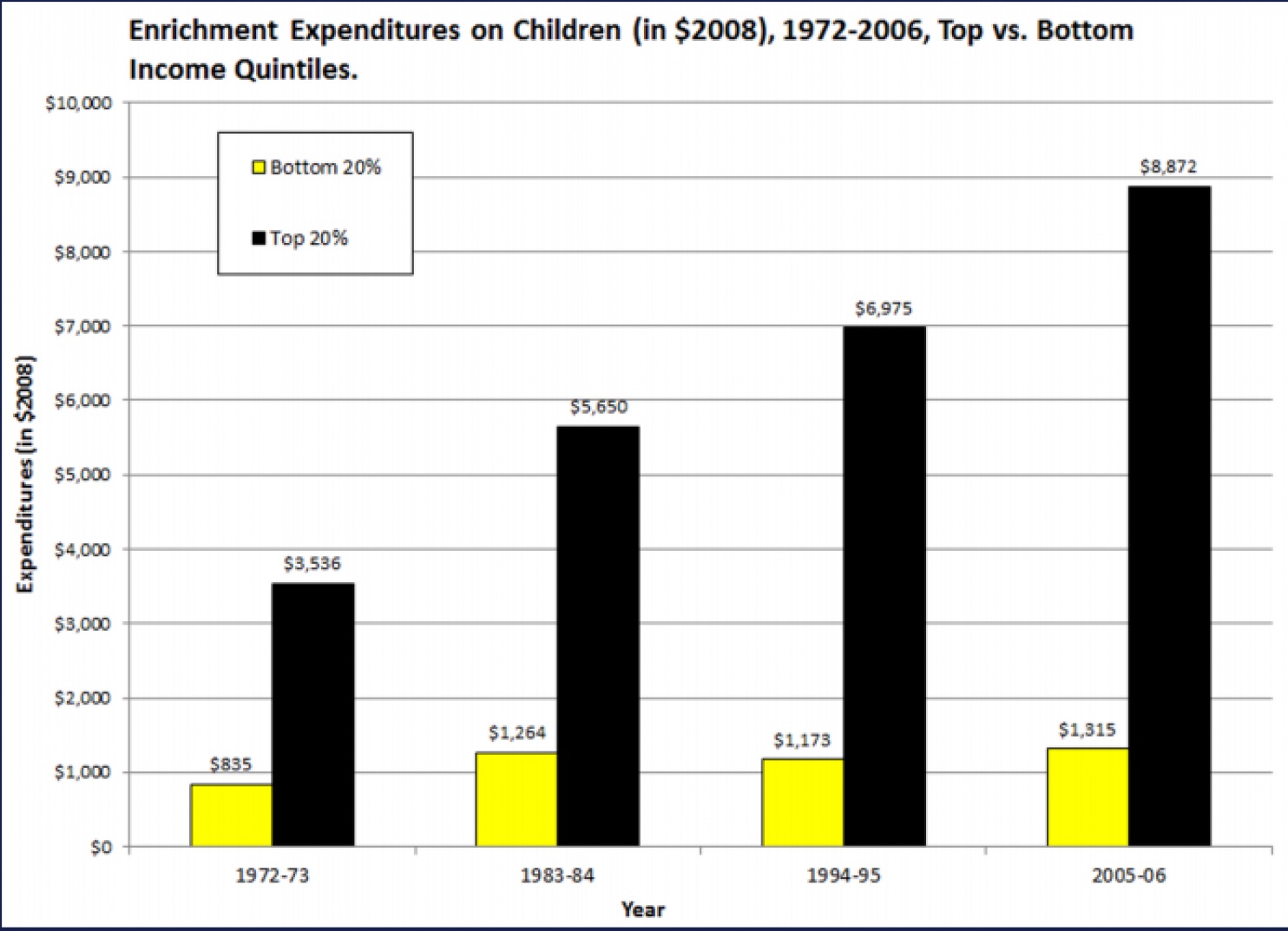

A recent presentation by economist Sheldon Danziger featured the following figure, showing the growing disparity between what low- and high-income parents spend on “enrichment goods” for their kids. What are such “goods?” Well, if you’re an affluent parent, just think about what you spent money on over the last few weeks vis-à-vis your kids. Was it, like a guy I see every day in the mirror, volleyball tournaments, art supplies, books, a new MacBook, a trip to South America to help build homes? Was it high-quality child care or private tutoring? Those are enrichment goods and wealthy families used to spend four times as much as low-income families on such goods; now they spend seven times as much.

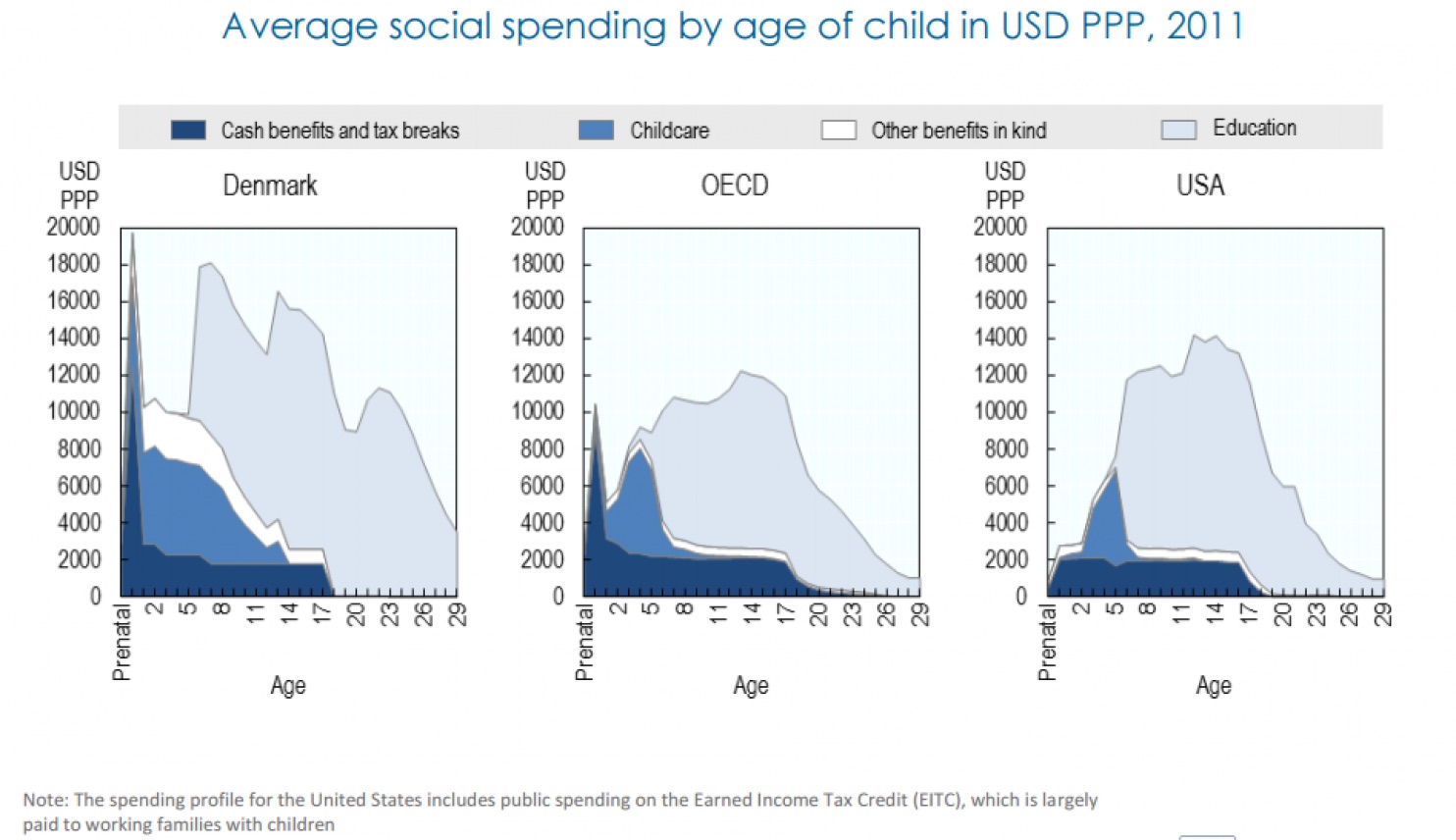

I'd like to tell you that we’re making up the difference with public expenditures targeting economically vulnerable young kids, but we’re not. On the other hand, other countries are. This next figure provides a fascinating comparison. It compares average public spending per child, by age and type of spending, between the United States, Denmark and the OECD countries combined (that’s the Organization of Economic Cooperation and Development, which includes the advanced economies and some of the emerging ones). While we clearly invest a lot less in kids than the Danes, at first glance, the United States doesn’t look that different from the rest of the OECD.

But look at the left end of the graphs. We invest much less in young children, and that stems largely from the fact that most other advanced economies view early childhood education, child care and other benefits targeted at parents with young children as “public goods,” meaning investments that, absent public support, would be insufficiently made from the perspective of society’s well-being.

That implies that the benefits to spending on, say, pre-K education end up being worth more than the costs. And here we turn to the quality evidence I mentioned earlier, which has thankfully been collected by economist Tim Bartik in his book “From Preschool to Prosperity” (which is free on the Web; what kind of economist does that?).

Bartik points out that because we don’t do enough of this sort of investment, we have “better evidence for the effectiveness of early childhood education than for almost any social or educational intervention. [That’s] because we have good comparison groups. Ironically, these good comparison groups arise because early childhood education is not universal, so many children are excluded from services.”

The controlled experiments find that in later adulthood, kids who benefit from early childhood education earned more than kids who did not. In some cases, the earnings premium goes as high as 25 percent. But even the lower-end outcomes of 3 percent amount, as Bartik notes, “to many thousands of dollars” over a long career. Even Head Start programs, which often get pilloried in this debate (and which, to be fair, vary considerably in terms of quality) were found to lead to increases in educational attainment and crime reductions for some participants later in life. One study that compared siblings — one was in Head Start, the other wasn’t — found average earnings gains of 11 percent.

Bartik finds that the earnings benefits-to-costs ratios to the programs he reviews range from 1.5 (for every dollar spent, the program yields earnings gains of $1.50) to 5. A more inclusive study that factored in more than earnings (e.g., savings from fewer public benefits and less involvement with the criminal justice system later in life) found the benefit-cost ratio to be 8.6-to-1.

Finally, Bartik notes an important spillover. We want parents of poor kids to work, but relative to other countries, we do little to help them afford decent day care for their kids. So here’s a double benefit: provide extensive early-childhood education and we’ll improve kids’ futures tomorrow and parents’ opportunities today.

There is no shortage of ideas as to how to scale up our disparate early childhood initiatives across the states. Bartik outlines an ambitious plan that would cost $79 billion a year; that’s the 10-year cost of President Obama’s idea, one I hope to see in his budget out soon. The Center for American Progress’s plan is worth a close look, as they’ve hashed out a lot of the gnarly design issues.

Yeah, yeah … I know: what’s my “payfor?” Even plans with net future benefits need to be paid for today (apparently, tax cuts do not, but that’s a different problem). How about a tiny, one-hundredth of a percent tax on security trades (stocks, bonds, etc.), i.e., a small financial transaction tax? That would raise more than enough to pay for the CAP plan or the president’s plan.

But with inequality on the rise, opportunity on the run and large net benefits left on the table year after year, to not make these investments in young kids is just … well, we’re not allowed to say “stupid” in my house, but if we were, that’s what I’d say.